About

Learn about us and what we do

Our Distinction

Most of our peers are product driven – you know the ones that show up in your office touting the latest and greatest product that “all” of your clients need. We are process driven, solutions driven and service driven. It might seem trivial, but the difference is immense. Let’s face it – the products that any marketing organization offers are not unique – the industry is finite and we all have access to the same widgets.

We believe that you can sell more if you have a better way. If you have a better process. We provide results proven client generation, client engagement, client conversion, case design and case management support. Yes, client generation, engagement and conversion (translation – we help you get more clients). When you work with us, you will have a dedicated relationship manager who will work with you to implement effective processes, services and solutions – not just a products.

Support for the

RIA

Your business is changing. Downward fee pressure and technology based competition are making you either accept a reduction in pay or bring on more assets to keep your compensation the same. If you want to keep your fees the same without increasing volume, you have to deliver more to your clients than just a good asset allocation.

We can help. Your high net-worth clients need advice on income replacement, business transitions and estate planning concerns. They already trust you with their money – you are a natural fit for guiding them through these issues. If you don’t talk to them about it, someone else will… and if that someone else also manages money, for 40 bps less than you… you know where it could lead. With C.O.R.E.’s help, you just have to ask your clients what they want, and we can help you with the rest.

Are you a fee-only advisor? Don’t let that stop you from calling us. We work with fee-only and fee-based advisors – there is a way to make insurance planning align with your business model. Don’t let that obstacle stop you from at least finding out your options.

Your industry is changing. If you want to remain relevant, you have to change as well. We can help.

Support for the

Broker/Dealer

Whether you already have an insurance department or simply want to understand how you can profit from the business your reps are doing away from the firm without changing what they receive, we can help. We work with several large independent broker-dealers and bring the following benefits:

- Development or outsourcing of insurance department infrastructure

- Product training for reps

- Concept training for reps

- Marketing initiatives

- Suitability and due diligence reviews

- Training of internal insurance department staff

- Multiple compensation structures – including production credits

- Top-down initiatives to encourage organic growth

TESTIMONIALS

We have had the pleasure of working with a lot of great people over the years. Check out our testimonials page to hear from them!

Who we are

About Us

On the surface, we help advisors like you implement life, annuity, long-term care and disability income insurance solutions with their clients.

If you look a little deeper, you will find that C.O.R.E. is unique – we are Centered On Relationship Enhancement – our business is, at its center, a relationship business. You know that your success is determined by the quality of your relationship with your client. We know that our success is determined by the quality of our relationship with you. So we have built tested, tried and true systems and processes that help us enhance our relationship with you, which will help you align with your clients, optimize your client outcomes, and ultimately enhance your relationships with your clients. It’s no secret that the best client relationships are the most profitable and most enjoyable. Wouldn’t you like to have more of them?

If you are an experienced insurance producer, you will find that we do all the things you would expect a marketing organization to do, and we do them exceptionally well. You will also find that our culture is different and our approach to helping you improve upon what you are already good at is a welcome change in our industry, and will make a material impact on your production.

If you are a novice, you will find that by following our processes you can successfully build out a profitable risk management book of business. And you won’t have to quit your day job to accomplish it.

If you have tried implementing risk management strategies in the past and hated it….we urge you to try again with us. We know how to do it well, and promise that if you follow our lead, it won’t be painful like it was the last time you tried it.

Take the first step to developing a relationship with us – register today.

Because of our volume and the quality of the business we submit, we have top tier contracts with all carriers. Our payouts to reps like you are high – even if you think you’ve got the best payout out there, check with us. It’s just a call.

Our Advanced Team

No matter how long you have been in the business, chances are you might find yourself with a client whose needs are more advanced than you’ve dealt with ever, or in a while. And while insurance in and of itself is pretty boring, the tax law surrounding it can be a doozy

We have a team that specializes in helping you understand, present and implement:

- Estate planning solutions

- Estate transfer solutions

- Business planning – buy/sell

- Key person

- Non-qualified executive compensation

- Retirement Income Supplementation

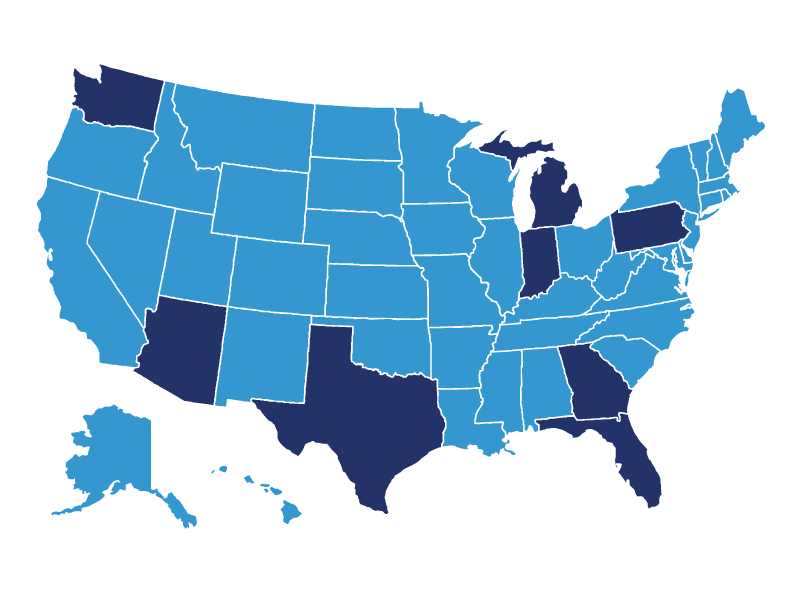

We provide nationwide support & coverage with Team Offices in each of the dark blue states below:

We’ve been doing this for over 20 years.

OUR TEAM

We’ve been doing this for over 20 years – it’s not our first rodeo. Over the years, we have built a team of professional, intelligent and talented folks who actually love what they do every day. That translates to a pleasant experience every time you interact with us.